With 2020 being one of the hardest for the global freight industry, air cargo freight has made a comeback with exceeding pre-COVID volumes with expert saying that the air cargo freight growth is back to volumes that are pre-US-China trade war. The IATA confirms that it is difficult to compare 2021 to 2020 figures due to the impact of COVID.

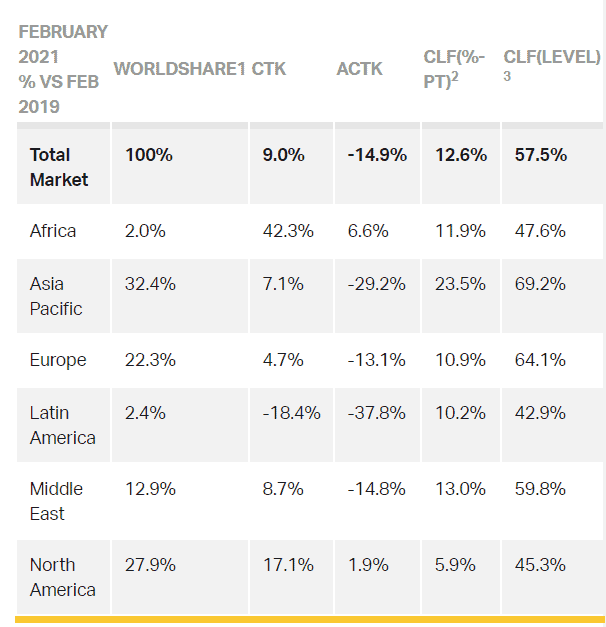

Despite the pandemic still not completely over, February 2021 showed a 9% increase from February 2019 and was 1.5% higher than January 2021 in terms of cargo tonne km (CKTs) demand. Whilst there has been an increase, the available cargo tonne km (ACKTs) has dipped due to global capacity issues. The fact that there is a 9% increase in demand from pre-pandemic times shows evidence that air cargo freight growth is present and it is not merely recovering from COVID-19. Whilst the overall freight industry situation is still in a state of limbo, the air cargo freight growth is a positive mark. This is an indicator that government officials need to make due amendments and planning to facilitate in order to restart the industry in a safe way.

One of the main contributors to the air cargo freight growth is the manufacturing sector which has weather well against the COVID-19 pandemic. Furthermore, based on the Purchasing Manager’s Index also known as PMI, anything above 50 indicates growth, whereby the PMI was 53.9 in February 2021. It is also thought that the reason for the air cargo freight growth is because of supply chain delays which has also resulted in delivery delays. With air cargo, supply chain management has been able to meet their deadlines and milestones despite the added costs of air freight rates. In terms of Asia-Pacific air freight, there was a demand hike of 7.1% in February 2021 compared to that of February 2019 whilst capacity was down 29.2%.

– CTK: cargo tonne-kilometers measures actual cargo traffic

– CTK: cargo tonne-kilometers measures actual cargo traffic

– ACTK: available cargo tonne-kilometers measures available total cargo capacity

– CLF: cargo load factor is % of ACTKs used